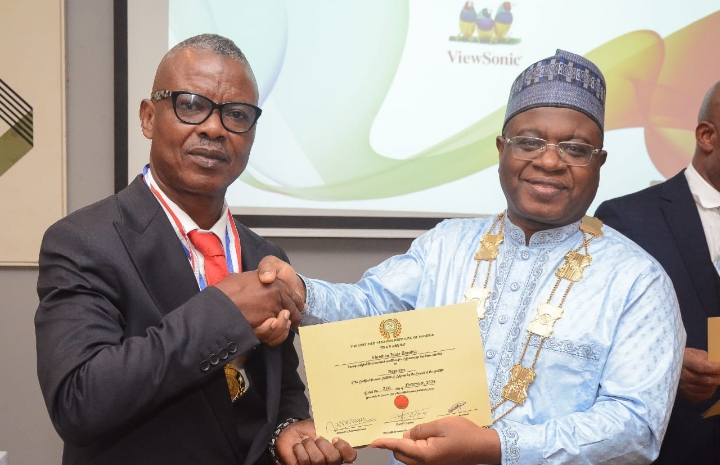

The Certified Pension Institute of Nigeria (CPIN) has inducted 23 professionals as fellows of the institute and nine others as associates among them is Mr. Anyalisi Isaac Christian.

The President/Chairman of the institute, Alh. Umaru Kwairanga, at the investiture of the inductees in Lagos, enjoined them to be good ambassadors of the institute in their various organisations.

Umaru told them to do this through their conduct and professional utterances.

In his words: “The inductees are distinguished and accomplished individuals in pension practice and associated financial services in the country.”

He maintained that the institute would extend access to people in employment without university degrees and undergraduates to start their student registration process which would enable them to take up examinations.

Speaking on the theme of the induction, ’20 Years of Pension Reforms In Nigeria’, the institute’s president noted that pension issues had become more prominent in the last 20 years.

Kwairanga charged the pension professionals to assess the journey of the industry so far, appraise the challenges and be part of the team that would work out improvement.

“We gather to strive for professionalism as a body, whose membership pursuit is scholastic and scientific.

“We will use our professional competence to help our country and achieve its transformation by jointly addressing pension problems in the country,” he said.

In her lecture, Mrs Folashade Onanuga, Managing Consultant, Motodols Pension Consults, said that while the pension reforms in the last 20 years had recorded remarkable successes, there were some challenges that needed to be addressed to make them more effective.

Onanuga, who is a former Director General, Lagos State Pension Commission (LASPEC), said the objectives of the reforms include the establishment of a uniform set of rules for pension administration in the country.

She added that the reform ensured that retirement benefits were paid as and when due; that it inculcated a saving culture in employees, and thereby assisted them in saving toward their retirement.

“The 2024 pension reforms made Group Life Assurance scheme for the provision of death-in service benefits mandatory and for premium to be paid by the employer.

“Introduced transparency and accountability by ensuring that every employee maintains a Retirement Saving Account (RSA) with a unique Permanent Identity Number.

“It also introduced the concept of private sector management of pension funds, PFAs and PFCs, with the regulatory body, PenCom, being an agency of government, among other reforms,” she said.

According to her, the notable achievements of the reforms in the last 20 years included build-up of over 20 trillion in pension assets, ease in pension administration through automation and digitalisation, among others.

Onanuga, however, noted some of the challenges of the pension reform to include low coverage, both in formal and informal sectors, delay in contributions, inadequate or no funding of the accrued pension rights.

She also highlighted inadequate benefits, limited awareness of the scheme’s benefits, unhealthy competition, and delays in payment of terminal benefits as some of the challenges.

In his remark, the Executive Secretary, CPIN, Dr Samson Akinyemi, appreciated the institute’s Board of Directors and the inductees for their commitment and involvement in the progress of the institute.

Akinyemi stated that the institute was working to secure its Chartered status.

This, he said does not, however, hinder the institute’s operation as a certified body.

He called for collaboration among practitioners and operators to properly reposition the industry and create more awareness of its operations and mandate.

Responding on behalf of the inductees, Mrs Emem Umoh, hailed the institute for taking a step in the right direction to grow the institute.

Umoh pledged, on behalf of her colleagues, that the inductees would contribute to the growth of the institute and the industry.

Mr. Anyalisi Isaac Christian is a member of the academic and professional community was also Inducted as an Associate member, CPIN along side others.

Anyalisi is also a Chartered Stockbroker with about 20 years experience, Chartered Secretary, Certified Pensions Consultant and an Authorized Dealing Clerk of the Nigerian Exchange Group Plc, formerly (Nigerian Stock Exchange) with a Masters Degree in Finance from Lagos State University among other Certifications.

CIPN is a professional body representing pension professionals in the private and public sector.

The Inductees includes:

1.Sir Edwin Egwonomu Ogidi-Gbegbaje

2.Aliyu Mohammed Dahiru (MD/CEO, Tangerine APT Pensions Limited) with Assets Under Management in Excess of N350 billion

3.Christopher Babatunde Bajowa

4.Samuel Banji Abolarin

5.Hamisu Bala Idris (MD/CEO, Norrenberger Pensions Limited)

6.Mohammed Mai Moustapha (ED, Finance & Investment FCMB Pensions Limited

7.Faseluka Omotola Kikelemo

8.Comrade Lawson Efenudu

9.Atube Onyemeni Frank

10.Emem Umoh Umoh (Mrs)

11.Oluwaseun Rufus Babalola

12.Abiodun Shode

13.Osarhieme Osaghae

14.Akinwunmi Lawal

15.Adebayo Adeokun

16.Abiodun Taiwo Samuel

17.Olugbenga Olusola Oriowo

18.Adeniran Semiu Abiodun

19.Amaonwu Chukwuma

20.Yusuf Olanrewaju Saheed

21.Azeez Babatunde Olasunkanmi

22.Abubakar Amina Ibrahim (Mrs)

23.Ifeanyi Onyimadu

24.Orimolade Olufolake Olusayo

25.Olalekan Aborisade Anthony

26.Joy Oduola

27.Anyalisi Isaac Christian

28.Maryam Ahmad Hammanyero

29.Iwar Afa Catherine

30.Victor Nsa

31.Joyce Chinenye Isaac

32.Khadijah Abdul Sulaiman