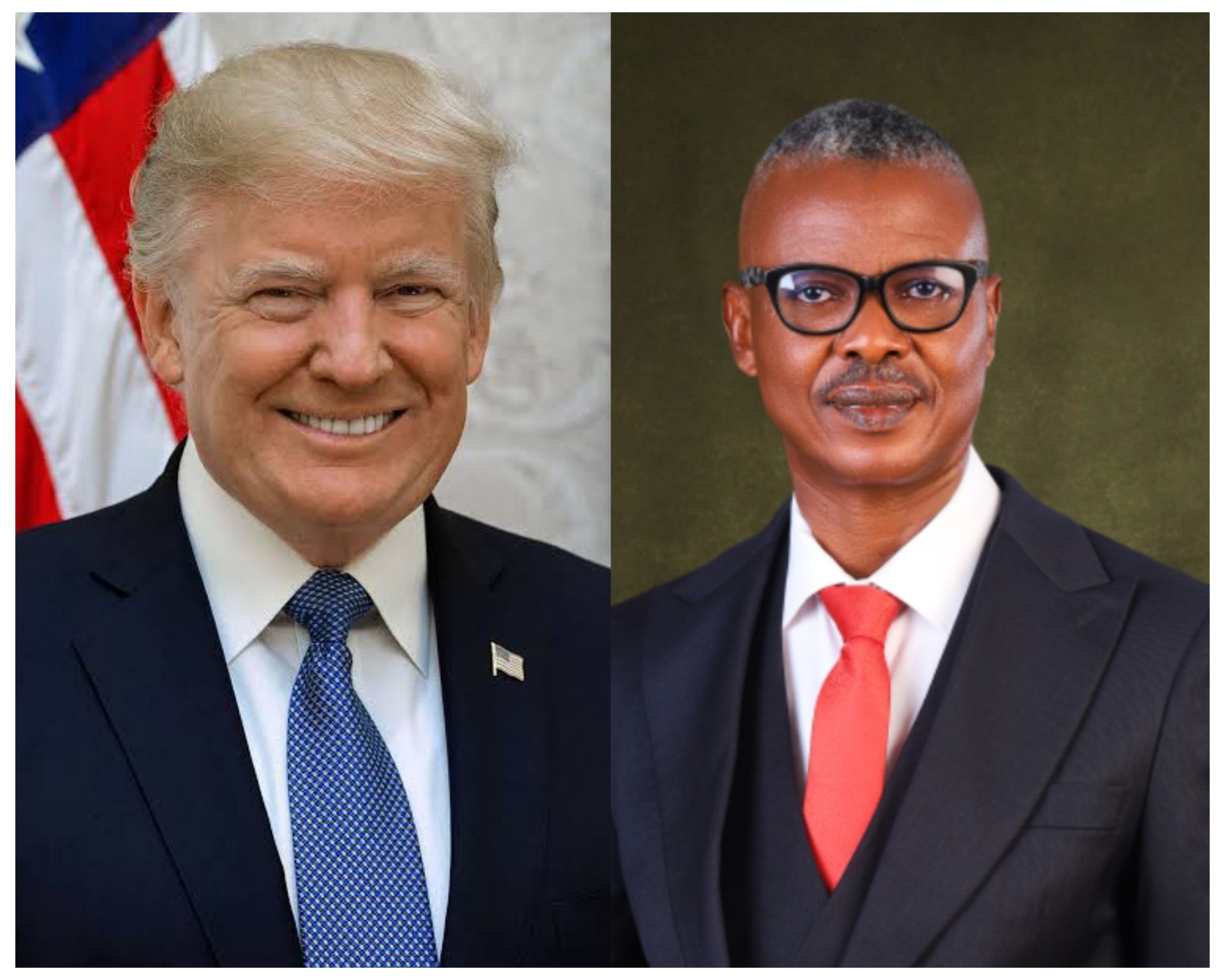

Nigerians have continued to react to Donald Trump’s victory as the 47th US President, with some congratulating him and others expressing concern. President Bola Tinubu was among the first to congratulate Trump, expressing hopes for continued strong US-Nigeria relations and economic cooperation.

Some have also continued to share their thoughts, with opinions divided between support for Trump and his opponent, Kamala Harris. While some Nigerians see Trump’s victory as a positive development, others are worried about the potential implications of his presidency.

It’s worth noting that Trump’s presidency has been a subject of interest globally, and his policies have had far-reaching impacts. As the second president in U.S. history to serve non-consecutive terms, Trump’s second presidency is expected to be significant.

Mr. Christian Isaac Anyalisi, Chartered Stockbroker/ Securities and Investment Analyst, noted that there are palpable fears about cuts in US grants and supports to protégé countries.

According to the expert: “Where this happens, it is expected to affect the flow of funds into the Nigerian economic system and consequently the capital market.

“However, such withdrawals could compel countries to develop resistance by adopting initiatives to fill funding gaps.

“We expect that policy makers at the center, particularly in the financial system will make necessary adjustments to attract investments from the USA, rather than shy away from capitalizing on the existing relationship with.”

He also said: “Donald Trump, from experience is an advocate of low interest rate. During his first tenure, the Federal Reserve Bank reduced interest rate to 2.5% and further down. Where this becomes the situation under the new regime, it will result in the outflow of investible funds from the US economy. In this vein, the Nigerian capital market, both the debt and equity segment is expected to benefit from this policy shift.

Low rates in the US economy will also lead to an increase in the flow of foreign exchange into Nigeria and as result, an increase in the value of the domestic currency.

Anyalisi opined that the “America First” stance of President Donald Trump, if carried through, may lead to a reduction in diaspora remittances.

However, he maintained that it is reasonable to expect that, the US economy has so much in connection with foreign nationals, that the idea of mass deportation could prove difficult.

“Data from Nairametrics and other sources has confirmed that diaspora remittances into Nigeria has contributed over $20 billion annually, thereby mitigating foreign exchange shortfalls.

“A negative shift in the immigration trend could hurt diaspora remittance”, he further stated.

ENERGY COST

With a focus on the reduction of energy prices by increasing domestic oil output, there could be global low oil prices which is likely to impact the oil revenue for budget financing in Nigeria, with a resultant increase in deficit budget financing through increased domestic borrowing. This development, when combined with elevated interest rates, (High Monetary Policy Rate), will create a crowding-out effect on the equities segment of the Nigerian capital market.

TRADE RESTRICTION, TARRIFS AND INFLATION RATE IN THE US

Another aspect of Donald Trump’s policy which could affect the Nigerian economy and the capital market is the anticipated trade restriction through the imposition of high tariffs on imported goods, with China having to pay 60% on goods imported into the US. This could exacerbate inflation in the US economy and spill over to Nigeria, in the form of increase in the cost of goods and services.

In the first half of 2024, Nigeria’s trade with the US stood at a whooping N2.2 trillion in imports and N2.8 trillion in exports. As one of the major trading partners of Nigeria, increase in the prices of goods and services in the US can affect pricing in Nigeria for machinery and pharmaceutical products, among others.

A BALANCED VIEW

Despite the gloomy picture suggested by the negative fallouts of the Trump policies, there are grounds for positive expectations in the Nigerian economy and consequently the Nigerian capital market. These outcomes are predicated on certain attenuating circumstances such as the effective implementation of the ongoing economic reforms of the current government.

OIL SECTOR REFORMS

The removal of the oil subsidy is yet to be fully exploited in the Nigerian economy. According to BusinessDay of December 12, 2024, foreign direct investment into Nigeria rose by 248% in the third quarter of 2024 to $103.82 million, attributable to sectoral reforms.

Experts in the oil and gas sector are of the opinion that Nigeria could hit $10 billion in new investments for deep-water gas exploration through tax incentives and other measures, outlined in a new policy framework.

Some of these funds will come by way of foreign direct portfolio investment which will channeled into the capital market.

BANKING RECAPITALIZATION

Interestingly, Donald trump is assuming office at a time when the Central Bank of Nigeria has taken steps to strengthen the financial system, by increasing the capital base of the Nigerian banks. With a robust capital base, the Nigerian banking system is in a position to attract businesses from the US economy. Increased business flows into the banking system will have positive co-factor implications for the capital market. This re-capitalization is expected to attract about N4.16 trillion into the financial system by March 31, 2026.

INVESTOR BASE OF THE NIGERIAN CAPITAL MARKET

In Q2, 2023, domestic investors accounted for 75% of total investment in the Nigerian equities’ bourse, with foreign investors at about 25%. By October 2024, foreign portfolio investment in the equities bourse fell to 16.67% out of N4.47 trillion (10 months Review) with domestic investors responsible for the balance of about 83.33%.

Total transactions between January 2023 to October 2024 stood at N8.05 trillion. Data from the Nigerian Exchange Group Plc (NGX) indicates domestic investor dominance in trading activity at N6.9 trillion, equaling 85.7%, with foreign investors at N1.15 trillion or 14.3% of total trades.

Further analysis revealed that, in the domestic investment space, institutional investors led with N3.86 trillion or 47.9%, while retail investors seconded with N3.03 trillion or 37.6% of total domestic investment.

Foreign portfolio investment inflows in the period between January 2023 and October 2024, reached N519.10 billion, while outflows recorded N635.86 billion – an Indication of short-term cautious approach of foreign capital providers into the Exchange, arising from macro-economic stability concerns

In October 2024, domestic investment increased by 0.81% from N451.60 billion in September 2024 to N455.27 billion in October 2024, while total foreign investment transactions Increased by 14.61% from N41.41 billion (about US$25.86million) to N47.46 billion (about US$28.33 million).

UNIFICATION OF MULTIPLE EXCHANGE RATES

This has assisted in fostering a market driven official rate, cleared verified FX backlogs, improved transparency in the market, tightened monetary policy and resulted in improved FX supply, which are stimulants for economic growth. However, more has to be done to drive increased FX earnings from non-oil exports, leveraging the devaluation of our domestic currency.

From the above analysis, it is possible to infer that, internal macro-economic policies, much more than the Trump presidency in US, will have greater influence on the Nigerian Capital Market.

Christian Isaac Anyalisi M.Sc, ACIS, ACIP, ACS, ADC, Chartered Stockbroker/ Securities & Investment Analyst writes from Lagos, Nigeria.

Email: isaacchristian2016@gmail.com