Abia State Governor Dr Alex Otti has expressed the readiness of the State Government to support the Nigerian Council of Registered Insurance Brokers (NCRIB) in strengthening the Insurance Sector.

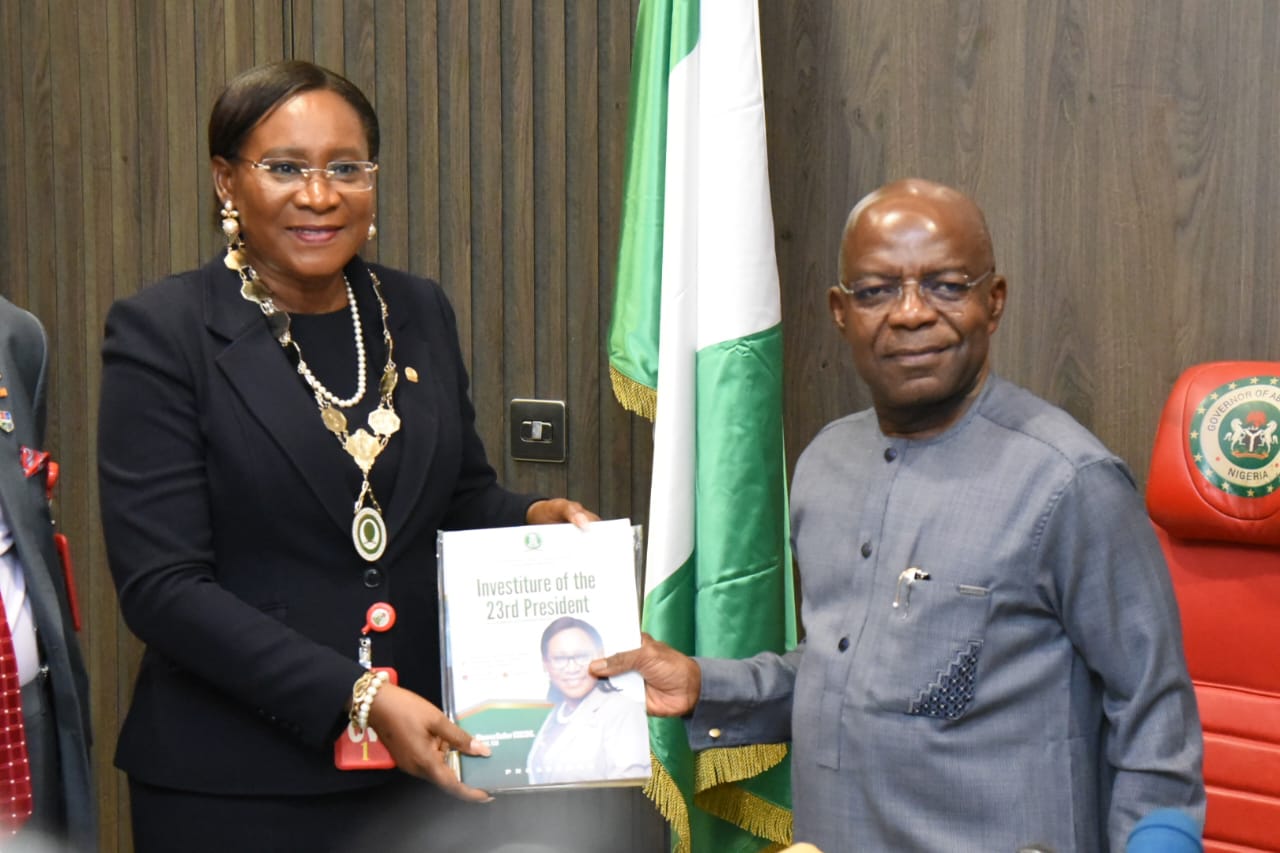

Governor Otti made the declaration on Tuesday, when he received a delegation of members of the Nigerian Council of Registered Insurance Brokers (NCRIB), led by its President, Mrs Ekeoma Ezeibe, in Nvosi Isiala Ngwa Local Government Area.

The Governor said that insurance could be made simple and trustworthy for Nigerians if properly explained and driven with integrity.

He said that insurance had over the years been perceived as one of the most difficult products to sell due to poorly explained documents and hidden exclusions, which often left policyholders frustrated at the point of claims.

According to the Governor, the emergence of the NCRIB has helped to correct these lapses by standing between insurance companies and customers, ensuring transparency and protection for the insured.

Governor Otti said that it was encouraging to know that the Council currently has about 600 registered insurance brokers nationwide, describing the proposals presented by the delegation on involving the Government in the Council ‘s initiatives in driving wider adoption of Insurance in the State, as not only innovative but reasonable.

He explained that although Government’s traditional role was to provide an enabling environment for businesses, the presentation before him suggested a more active Government role in driving insurance penetration.

The Governor said; “In the past, what often happened was that individuals entered the insurance industry and presented documents that people barely read and by the time one appended a signature, there were exclusions hidden in tiny print that ruled out exactly what one intended to insure.

“The emergence of the Nigerian Council of Registered Insurance Brokers has helped to address this problem by standing in the gap between insurance companies and their customers.

“It is also interesting to note that you have about 600 registered insurance brokers.What you have presented is reasonable, even though it appears novel.

“Ordinarily, Government’s role is to provide an enabling environment and allow businesses to operate freely, while critically evaluating interventions.

“However, this appears to be a call for Government to step into the arena and drive the process, as I understood you.

“I have no problem with that, as long as value is delivered, particularly to the insured”.

The Governor directed his Special Adviser on Internally Generated Revenue, Dr Emmanuel Okpechi; Special Adviser on Monitoring and Evaluation, Mr Ugochukwu Okoroafor; and Technical Assistant, Mr Charles Egonye, to work with the NCRIB team to fine-tune the details of the initiative.

He expressed confidence that implementation could begin as soon as arrangements were concluded.

Governor Otti also thanked the Council for selecting Umuahia as the venue for its 2026 CEOs’ Retreat, assuring it of the State Government’s support for a successful event.

The Governor expressed confidence in the leadership of Mrs Ezeibe, saying she would take the NCRIB to greater heights, while stressing the importance of competence and capacity building.

He further emphasised the need to attract young people to the insurance profession and highlighted the Abia Leadership Academy, which trained about 1,000 youths last year as part of efforts to groom future leaders.

Governor Otti reiterated that the State remains open and non-discriminatory, noting that appointments in his administration were based strictly on merit.

He assured the delegation that the State was ready to welcome investors and businesses, inviting them to establish operations in Abia as partners in development.

Earlier in her presentation, the President of the Nigerian Council of Registered Insurance Brokers (NCRIB), Mrs Ekeoma Ezeibe, underscored the critical role of Insurance in promoting sustainable economic development.

Mrs Ezeibe stressed that growth-driven infrastructure and commercial revival must be supported by effective risk management.

She emphasised that sustainability remains central to the success of these interventions, describing insurance as a vital tool for business continuity, protection of public assets and private investments, and the strengthening of the social contract between Government and citizens.

According to her, insurance penetration supports private sector growth, encourages tax compliance, and creates a virtuous cycle of development and stability.

Mrs Ezeibe also highlighted recent reforms under the Nigerian Insurance Industry Reform Act (NIRA) 2025, which expanded compulsory insurance coverage, and disclosed plans to establish an insurance brokerage marketplace in Aba to extend micro-insurance to traders and small businesses.

She said the initiative would protect vulnerable enterprises, create jobs through enforcement and compliance, and serve as a model for expanding insurance access across other States.

Mrs Egwuibe commended Governor Otti for reversing years of infrastructure decay in Aba and other parts of the state, noting visible improvements in markets and road networks that have helped to restore commercial activities.

She recalled that Aba, once the commercial hub of Eastern Nigeria, had suffered prolonged neglect that weakened trade and export activities, a trend she said had changed under the current administration.